No one likes losing money, but when you live abroad and need to transfer your money between currencies, you face two international banking problems that both end up leaving you with less than you started with. The first is the exchange rate because it’s not always in your favor. The second is the transaction fees, wire fees, and other ways banks get a piece of your pie. To make international transfers as seamless as possible and leave more of your money in your pocket, you need a service that gives you a competitive exchange rate and has low fees.

For international transfers and other cross-currency banking needs, I can’t recommend Wise (formerly TransferWise) enough and feel it’s the best way to send money abroad. I wish I had discovered it sooner. I didn’t realize just how easy and cost effective it would be. How does Transferwise work?

TransferWise review: How does Transferwise work?

Photo credit: Shutterstock.com / amirraizat

Back in the day when I first moved to France, we wanted to buy a car so I needed to transfer my American dollars into our French account. I wasn’t aware of (Wise, formerly called TransferWise) or similar services at the time and ended up with a terrible exchange rate and a US$50 international wire fee through my American bank. Not to mention the week I had to wait for the money to arrive. Then, I learned that there was a better way.

Enter TransferWise, a UK-based money transfer company that I’ve found to be the best way to send money abroad…

But first, why would you need to transfer money between currencies or hold a balance in another currency?

TransferWise is worth a look if you fall into one of the following categories:

- Expats sending money to their home country

- You need to make a big purchase in another country such as a home, car, etc.

- Those living in more than one country and having to regularly pay bills in more than one currency

- You need to send money abroad to a friend or family member

- International students paying their tuition

- Freelancers and digital nomads receiving payment from clients in different currencies and wanting to avoid major bank fees

- You’re heading on vacation somewhere that uses another currency (or travel there regularly) and want to pre-fund your trip, pay for a tour, or have a balance in that currency. Paying in that currency is usually more cost effective and having a balance allows you to withdraw cash while there and not have to deal with getting ripped off at a money exchange counter at the airport.

- Retirees receiving pensions abroad. With the borderless account, you can receive your pension as if you had a local bank account and convert that money with low fees — much cheaper than using your regular bank.

How does Wise work?

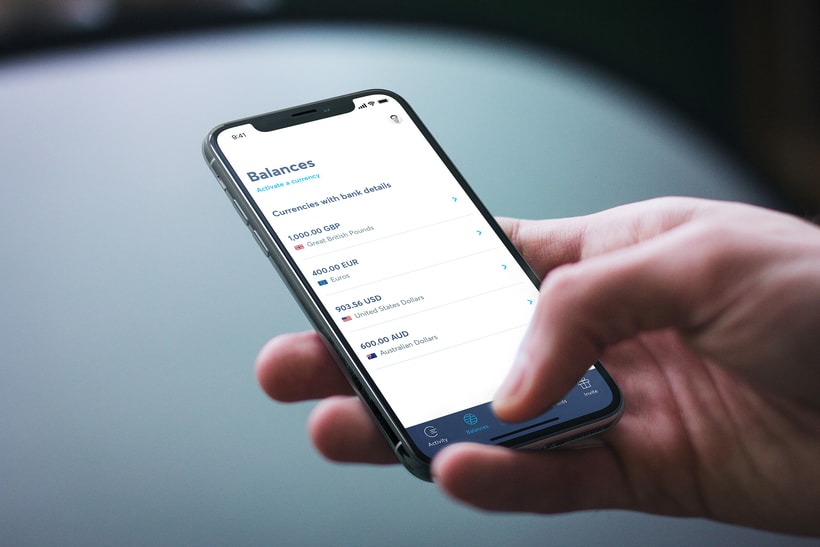

Here’s what Wise does. They allow you send money abroad first and foremost. On top of that, you can hold a balance in another currency via their borderless account and without all the hidden fees that come with doing international bank transfers through your home country bank. Everything can be done from a handy mobile app or their website.

It’s great for expats and anyone who has a need to transfer between currencies due to travel, work, etc. Really, opening a TransferWise account if you’re an expat or need to send receive money in different currencies is a must — even if you don’t use it often. I opened my account last year and am super happy with the service.

There are several reasons why TransferWise is the best way to send money abroad:

- The competitive rates

- Safety

- Speed

- Availability of countries/currencies

You get the actual mid-market exchange rate with no hidden fees. No inflated exchange rates here! That alone is enough to use TransferWise because for large transfers, the amount you save is literally huge.

Fees do vary though based on the amount you’re sending and the currency/country. More on Wise fees here.

Since 2011, over 6 million customers in 71 countries have used Wise. And every month, they move over £4 billion. Their website explains they must “follow a strict set of rules set by regulatory agencies in every single country [they] operate in, from the FCA in the UK to FinCen in the US” so your money is secure.

Photo credit: TransferWise

How to send money abroad with TransferWise

- Create your account

- Set up a transfer in the app or online

- Add the recipient’s bank details

- Fund your transfer via card or bank transfer

- Wait for confirmation

You can read more details about how sending money abroad works here.

It’s super easy to set up an account with a few clicks and no red tape. You can fund your account a few different ways such as a bank transfer, credit card, debit card, etc. All methods have low fees which are clearly spelled out before you initiate any transfers.

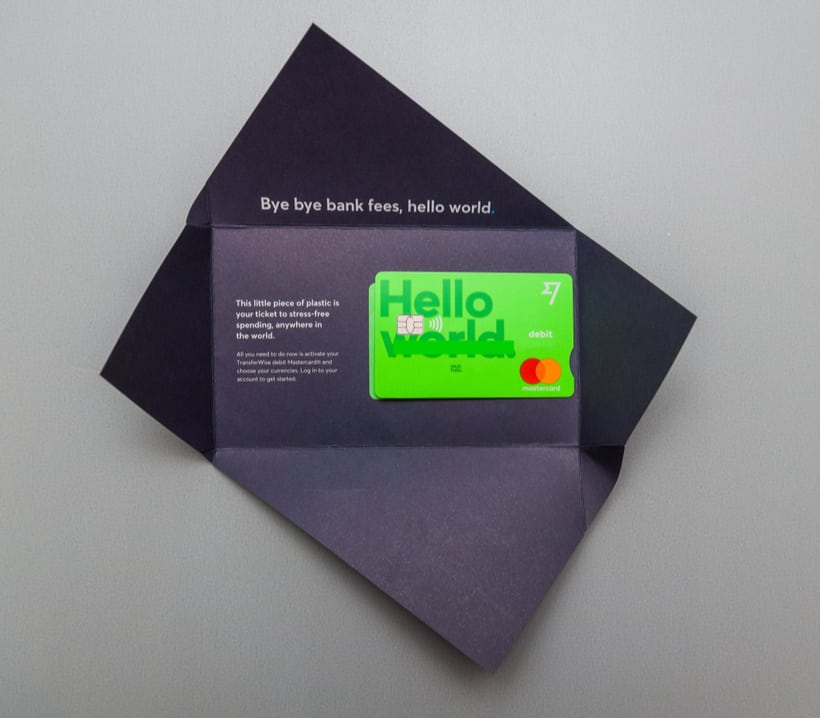

Here’s something else I love about Wise. On top of being able to send money abroad, Wise allows you to hold a balance in multiple currencies through their borderless account and access it all via a brightly colored debit card (that arrived in my mailbox in just a few days). I live in France and can hold a balance in euros with Wise France.

It’s all easily managed online or via their app and you’ll never lose the card in your wallet because it’s neon green. The best part about opening a Wise borderless account is free. There’s no cost to open an account, no monthly maintenance fees, and only a 5 euro one-time fee for the debit card.

That stands in stark comparison to French banks where just the card can cost 30 euros per YEAR plus monthly fees. The TransferWise borderless account is the first platform offering true multi-country banking to anyone who needs it, no matter where they live in the world.

They also have a business account option that makes doing business across borders cost effective and simple.

How does Wise work? Here are the details of a Transferwise borderless account:

- Hold and manage money in 40+ currencies. I have three: USD, Euro and British Pound.

- Receive, send, and spend in foreign currencies.

- You get local account details for USD, EURO, GBP, AUD, and NZD (account and routing numbers so you can receive money, set up payments, etc.).

- No monthly maintenance fees or receiving fees. Low-cost contactless Mastercard debit card too.

Photo credit: Shutterstock.com / Hadrian

About the Wise debit card for France and beyond

The borderless account comes with a Mastercard debit card as shown above. You can use the Wise debit card anywhere in the world and get the actual exchange rate — not whatever inflated rate your regular bank charges. Conversion fees are low (between 0.35% and 1%) and there are zero transaction fees.

It’s free to pay with currencies in your account and you also get free ATM withdrawals up to £200 a month. If you don’t have a balance in a particular currency, no problem. Pay in any currency, anywhere and it will automatically convert the currency in your account with the lowest conversion fee.

By the way, if you’re looking to open a free bank account in France (not looking to send money abroad or transfer between currencies), online bank N26 is my simple and free pick for that.

Photo credit: Shutterstock.com / rafapress

Some of you reading this might be wondering what’s so good about Wise and why it’s the best way to send money abroad if you have a home bank that offers free withdrawals abroad at the real exchange rate. US-based Capital One 360 does exactly that — free ATM withdrawals abroad and no fees.

But not everyone has a bank that offers free ATM withdrawals abroad and that’s only one part of what Wise does. It gives you the simple ability to send and receive funds in a variety of currencies and hold a balance in that currency for minimal fees. So it’s just another tool in your toolbox if you regularly have to send/receive money or transfer between currencies.

What I love about Wise and the borderless account

- Easy to use app that’s straightforward and clear

- Completely transparent pricing about TransferWise fees

- No account maintenance or setup fees

- Being able to hold a balance in multiple currencies

Disadvantages of TransferWise

- Transfers are not instant. Depending on the amount and country, transfers can take a couple of days to complete. You see the arrival date upfront before you initiate the transfer so there are no surprises (and sometimes the funds arrive before the date in the system) but it’s not instant.

- Not all currencies/countries are supported. Two I’ve had a need for that aren’t available are Bosnia and Rwanda.

***

How do you send money abroad? Is Wise a service you’d use? What have you found to be the best way to send money abroad? Learn more on their website here.

Hope you enjoyed my TransferWise review!

Disclosure: I am a Wise affiliate which means I may make a small commission if you open up an account. I only recommend products and services I use and love and Wise is the best way to send money abroad, hands down. Thanks for supporting Oui In France.

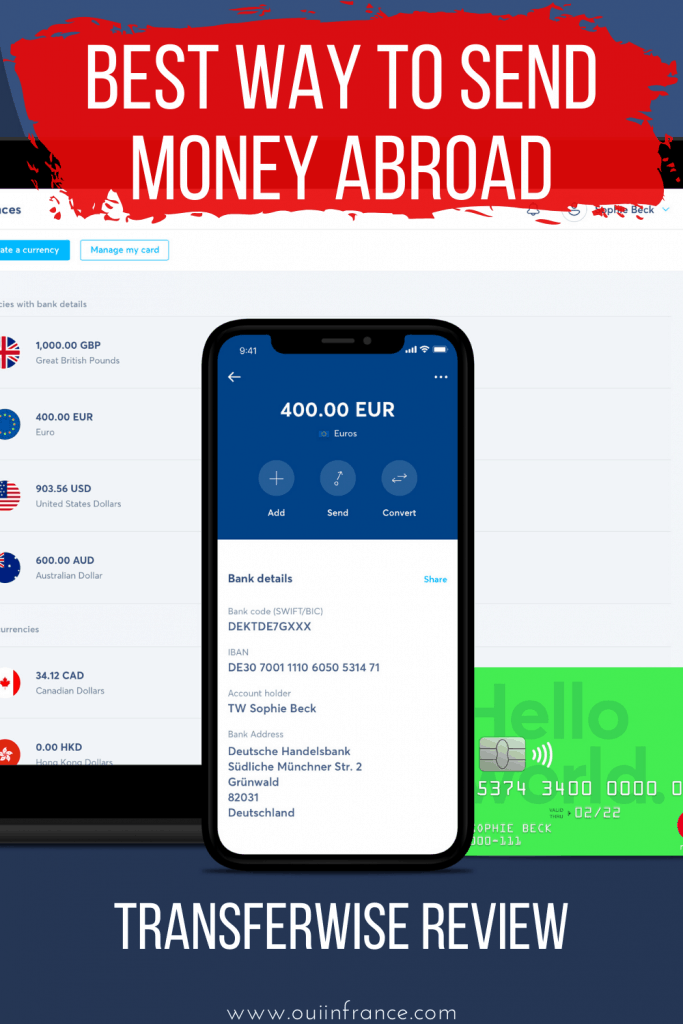

PIN MY TRANSFERWISE REVIEW POST:

I usually live and work in Paris (Covid-19 has me locked into my Boston, MA, area home for now, but i am still working remotely). My pay is directly into my Societe Generale (French bank) account. I discovered TransferWise and have been using it for all of the reasons described in Diane’s article. I can transfer money either way. Sometimes i need more in France. Most often i need to get my Euros back to the US. It is not instant, but Societe Generale will do an Euro transfer for free if you give it a day or two. TransferWise wants me to transfer to their Belgium subsidiary. They give you the RIB (bank transfer) information and a personal ID to use in the memo field. Once transferred, it is one more day for them to move the money to the US bank. All in all, a good service.

Hi there Mark! So glad you’ve had a good experience with TransferWise as well so thank you for sharing. Yes, I have found that different banks can do a portion of what TransferWise offers like the Capital one account I mentioned and how I could access free ATM withdrawals so I use my American bank for that because it’s just easier and I carry a higher balance there. But for actually sending money and all the different currencies TransferWise is the way to go! Take care 🙂

Am also a big fan of Transferwise! I discovered them last year and sent money to myself when starting out in France, and used it again to send euros to dollars when I left France. I also have a borderless account that I haven’t used yet, but I love the concept and imagine it’ll be really convenient. It’s definitely especially helpful since opening and closing a French bank account is a mess, and as you mentioned, it’s not free to maintain!

Hi,

We are purchasing a home in France (we’re American) and understand we will need a French bank account for paying utility bills, taxes, etc. I set up a TransferWise borderless account today. My question is, are there any situations where I will still need to set up a traditional French bank account? Or will the TransferWise account handle all my needs?

Is Wise(TransferWise) more widely used than PayPal worldwide❔

Salut, Diane. Nothing, just asking .

I, too, am a huge Transferwise lover. I used them for the first time last year to transfer funds to myself as I settled into life in France, then again when I left the country to convert euros to dollars. I have a borderless account that I haven’t used yet but am excited to try because I think it will be quite useful.